- #New to quickbooks 2015 tutorial deffered revenues how to

- #New to quickbooks 2015 tutorial deffered revenues download

It makes perfectly clear to shareholders and other involved parties that the company still has outstanding obligations before all of its revenue can be considered assets. The bottom line Deferred or unearned revenue is an important accounting concept, as it helps to ensure that the assets and liabilities on a balance sheet are accurately reported.

#New to quickbooks 2015 tutorial deffered revenues how to

How to record revenues without using invoice or journal entries General bookkeeping questions that are not software specific. Conversely, this creates an asset for the seller, which is called accounts receivable.

#New to quickbooks 2015 tutorial deffered revenues download

Download CFI’s Deferred Revenue template to analyze the numbers on your own. At that point, the deferred revenue from the transaction is now 0. Other examples could include, but are not limited to The pattern of recognizing 100 in revenue would repeat each month until the end of 12 months, when total revenue recognized over the period is 1,200, retained earnings are 1,200, and cash is 1,200.

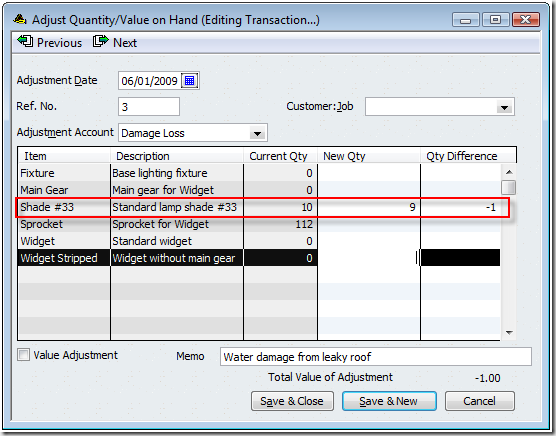

11, 2020 Cash management for FDIC security over short term cash spikes. Our state allows us to pay in 3 installment Answered by Wade Senti, Accountant Cash Management // Jan. For simplicitys sake, my yearly property tax bill is 12k. That money should be accounted for as deferred revenue until the job is complete - although the contractor can certainly use it to buy supplies to complete the job. I have been going rounds with this and need some help to make sure that my books are accurate. For example, when you hire a contractor to renovate your house, the contractor generally wants at least some of the money up front. Service providers are another example of businesses that typically deal with deferred revenue. The procedure described here for handling work in progress (WIP) or construction in progress (CIP) in QuickBooks assumes that all revenue and costs will be tracked as assets (for costs) and liabilities (for revenues) until the end of the job, when they'll be transferred to income and expense accounts.

0 kommentar(er)

0 kommentar(er)